Sukanya Samriddhi Yojana Details

| Yojana Launched By | Central Government |

| Department/Ministry | Ministry of Women and Child Development, Ministry of Human Resources Development, and Ministry of Health and Family Welfare |

| Objective | The government is providing the facility of opening such accounts for girls to save money, in which the government also gives good interest rates. |

| Yojana Launch Date | 22 January 2015 |

| Application Method | Online |

Introduction to Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana was launched on 22 January 2015 by the Indian Prime Minister Narendra Modi. This scheme was launched as a part of the Beti Bachao Beti Padhao campaign, which aims to save money for the education and marriage of girls. Under this scheme, the amount deposited also gets a good annual interest rate.

Objective of Sukanya Samriddhi Yojana

Education and marriage expenses are very expensive in India, keeping this in mind, our central government launched Sukanya Samriddhi Yojana in 2015, under which, for the bright future of daughters, their parents are provided the facility to open an investment account and save money, keeping in view their education and marriage expenses. Under this scheme, the government is also providing a good interest rate, so that parents can save money for a long time for their daughter’s higher education and marriage.

In this article, we will tell you how you can take advantage of this scheme if you are the parent of a daughter, so you will get complete information related to this scheme in simple words in this article.

Sukanya Samriddhi Yojana Eligibility

- The girl and her parents should be permanent residents of India.

- To open an account, the girl child should be below 10 years of age.

- Facility is provided to open only one deposit account in the name of a girl child.

How many girls’ accounts in a family under Sukanya Samriddhi Yojana?

Account can be opened for only two girl children in a family but if birth certificates of twins/triplets are available regarding birth of girl children in a family, then accounts can be opened for more than two girl children in a family.

Documents For Sukanya Yojana

- Birth certificate of a girl child

- Aadhaar card/PAN card/Identity card of one of the parents

- Residence certificate of one of the parents

- Passport size photo of the girl and one of her parents

Some other important points of Sukanya Samriddhi Yojana

- You can deposit a minimum of ₹250 to a maximum of ₹1,50,000 in the account every year

- It is mandatory to invest in the account opened under this scheme for a minimum period of 15 years

- If the minimum balance is not deposited in the account every year after opening the account, a penalty of ₹ 50 will be charged per year.

Who will get the money when Sukanya account holder dies?

In the event of death of the account holder, on production of death certificate issued by the competent authority, application in Form-2, the account will be closed immediately and the balance in the account and interest due thereon till the date of death will be paid to the guardian. Interest at the rate applicable to post office savings account will be paid on the balance kept in the account for the period between the date of death of the account holder and the date of closure of the account.

Under what circumstances can the account of the beneficiary girl child of Sukanya Yojana be closed prematurely?

Where the Accounts Office believes that the operation or continuance of the account is causing undue hardship to the account holder on extremely compassionate grounds such as medical aid in case of life threatening ailments of the account holder or in case of death of the guardian, it may by order after full documentation establishing the grounds for such closure and for reasons to be recorded in writing permit premature closure of the account. The balance in the account along with applicable interest shall be paid to the account holder or guardian, as the case may be, in accordance with the Scheme.

Using account funds for daughter’s marriage?

If the girl child in the account has attained the age of 18 years, then money can be withdrawn prematurely from the Sukanya Samriddhi Account in view of the need of money for her marriage.

Sukanya Samriddhi Yojana Benefits

- High interest rates

- Tax benefits under section 80-C of the Income Tax Act

- Payment to the girl child on maturity

- Interest payment even after maturity if the account is not closed

- Transferable to any place in India

- The girl child can operate the account herself after attaining the age of 10 years

- Deposits can be made in the account till completion of a period of 15 years from the date of opening the account

Banks For Sukanya Yojana

Below given is the list of government and private banks which are providing the facility of opening account under Sukanya Samriddhi Yojana.

- Axis Bank

- HDFC Bank

- Punjab National Bank

- ICICI Bank

- IDBI Bank

- State Bank of India

- Punjab & Sind Bank

- Central Bank of India

- Bank of Maharashtra

- Canara Bank

- Bank of Baroda

- Indian Bank

- Canara Bank

- Union Bank of India

- UCO Bank

- Bank of India

- Indian Overseas Bank

Sukanya Samriddhi Yojana Interest Rate 2024-25

| Time Period | Interest Rate (Percentage) |

|---|---|

| 01.01.2024 TO 30.09.2024 | 8.2 |

| 01.04.2023 TO 31.12.2023 | 8 |

| 01.04.2020 TO 31.03.2023 | 7.6 |

| 01.07.2019 TO 31.03.2020 | 8.4 |

| 01.10.2018 TO 30.06.2019 | 8.5 |

| 01.01.2018 TO 30.09.2018 | 8.1 |

| 01.07.2017 TO 31.12.2017 | 8.3 |

| 01.04.2017 TO 30.06.2017 | 8.4 |

| 01.10.2016 TO 31.03.2017 | 8.5 |

| 01.04.2016 TO 30.09.2016 | 8.6 |

| 01.04.2015 TO 31.03.2016 | 9.2 |

| 03.12.2014 TO 31.03.2015 | 9.1 |

Sukanya Samridhi Gramin Abhiyan

To spread the benefits of ‘Sukanya Samriddhi Yojana’ far and wide, “Sampoorna Sukanya Gram Abhiyan” was launched in June 2019. In this campaign, at least five villages will be marked as Sampoorna Sukanya Village (Gram). This includes opening Sukanya Samriddhi Account for all eligible girl children of that village.

Sukanya Samriddhi Yojana Registration

Application for Sukanya Samriddhi Yojana can be completed easily by following the steps given below.

Step 1: To register under Sukanya Samriddhi Yojana, first of all you have to go to your nearest bank branch.

Step 2: After this, you will have to take the form for opening Sukanya Samriddhi Account and after reading the information asked in it carefully, you will have to fill it correctly.

Note: To see the format of the form for opening Sukanya Samriddhi Account, click here – Sukanya Samriddhi Account Form

Step 3: After this, you have to fill the initial amount of the account and submit the form after attaching the required documents. After this, the concerned bank employee will open the account after checking the eligibility criteria related to your application.

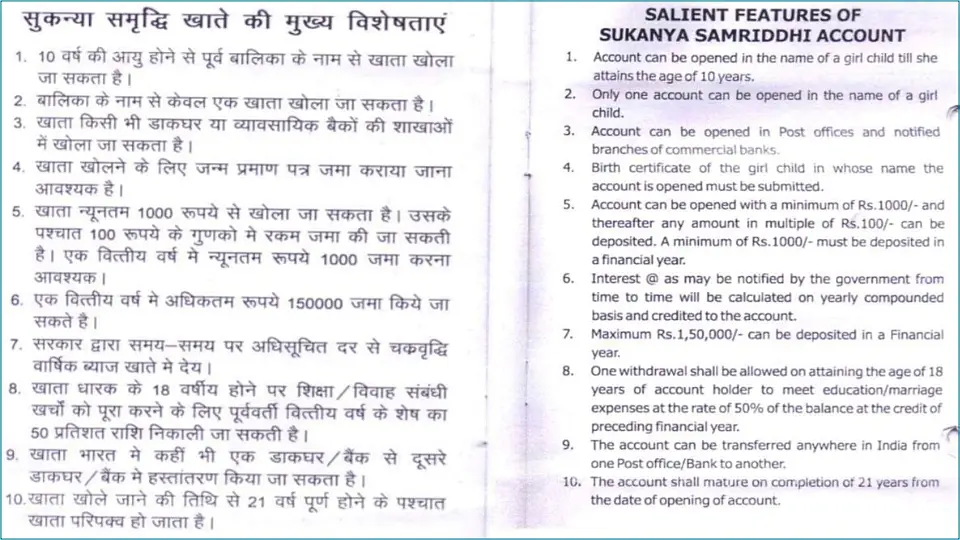

Note: The criteria related to the scheme are also written on the ‘Sukanya Samriddhi Account’ form provided by the bank. You can see the photo below as an example—

Frequently asked questions related to Sukanya Samriddhi Yojana

-

What are the rules for depositing money in Sukanya Samriddhi Account?

There is a rule to deposit minimum Rs 250 and maximum Rs 1,50,000 per year in Sukanya Samriddhi Account.

-

Can Sukanya Samriddhi Account be closed prematurely?

Yes, Sukanya Samriddhi Account can be closed before maturity if the account holder suffers from a serious illness or the girl child’s guardian dies.

-

When can I withdraw money from Sukanya Samriddhi Account?

After the girl child attains 18 years of age, 50% of the amount can be withdrawn for her marriage or higher education. Apart from this, the entire amount can be withdrawn after the girl child attains 21 years of age.

-

Why one should not invest in Sukanya Samriddhi Yojana?

If a person makes such an investment in Sukanya Samriddhi Yojana, the downside is that the money cannot be withdrawn whenever one wants under normal circumstances.

-

Which is the best bank for Sukanya Samriddhi Yojana?

To open an account under Sukanya Samriddhi Yojana, facilities are available in all the post office banks, other government banks or private banks.

-

If a girl’s father dies, what will happen to her Sukanya Samriddhi Account?

If the father of a girl child dies, her Sukanya Samriddhi Account can be transferred to another guardian.

-

Can I deposit Sukanya Samriddhi Yojana installment from my bank account itself?

Yes, you can deposit the installment of Sukanya Samriddhi Yojana from your bank account only. Information about this can be obtained from the bank branch.

-

What happens if I stop paying the Sukanya Samriddhi Yojana installments?

If you stop depositing installments in your Sukanya Samriddhi Account, a penalty of Rs 50 per year will start being charged.

-

Can I check my Sukanya Samriddhi Account balance myself?

To check the balance of your Sukanya Samriddhi Account, you will have to go to the same branch in which you have opened the account.

-

How much interest is being received currently under Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana will have an annual interest rate of 8.2% for the period from 01.01.2024 to 30.09.2024.

-

What is the age to register for Sukanya Samriddhi Yojana?

To avail the benefits of Sukanya Samriddhi Yojana, it is necessary to register the girl child before she turns 10 years old.

-

What are the documents required to register for Sukanya Samriddhi Yojana?

Birth certificate of the girl child, Aadhaar card/PAN card/identity card of one of the parents of the girl child, residence certificate of one of the parents, passport size photo of the girl child and one of the parents.

Know who will get the benefit of Pradhan Mantri Sukanya Yojana and how?

Reference Links: